This post was written by Tiffany Knight and co-authored by Emily Dobson especially for College Essay Guy.

Tiffany Knight

University Advisor at UWC ISAK Japan in Nagano, Japan

Educator | Advocate | Access Warrior

Emily Dobson

EDGE Direcionamento Educacional in Porto Alegre, Brazil

Mom | Educator | Executive Board InternationalACAC | Caribbean and Latin America Network Founder | Access Warrior

TABLE OF CONTENTS

- What makes this financial aid guide amazing?

- What costs do I consider before I even start college?

- Cost of applying to college

- Cost of Attending (COA)

- Creating a budget

- Understanding Estimated Family Contribution (EFC)

- College match/fit and list building

- Non-traditional or alternative pathways

- What are the types of financial documents required?

- CSS profile

- Students demographic information

- Parent information

- Student academic status

- Income and assets of parents and students

- Household information

- Parent expense details

- Supplemental questions

- CSS profile for parent use

- CSS profile dashboard

- CSS profile and IDOC

- Forms and status of submitted documents

- International Student Financial Aid Form (ISFAA)

- Student information

- Parent information

- Financial information

- Asset information

- Expenses

- Expected support/offer

- Special circumstances

- Changes to your financial aid application

- What to do once you're accepted

- A brief guide to analyzing your financial aid award letters

- How to appeal your financial aid offer

- How do I show gratitude for those who made a difference in my college journey?

- What Does that Word Mean? (A Glossary)

What Makes This Financial Aid Guide Amazing?

What follows is a short (well, as short as we could get it) overview of the financial aid process and possibilities for international students, including those with dual U.S. citizenship. We created this guide to help you:

See that financial assistance comes from several sources (and you can get it before and during college)

Provide context to understand the terminology used

Become more familiar with some of the documentation often required to receive aid

(Hopefully) feel empowered by this information

Luckily, we had a crew of international student interns helping us out; so if you think this booklet is AMAZING, that’s probably a major reason why.

Note: For the purpose of this guide, we will use “college” and “university” interchangeably. A definition is offered for each in the glossary section.

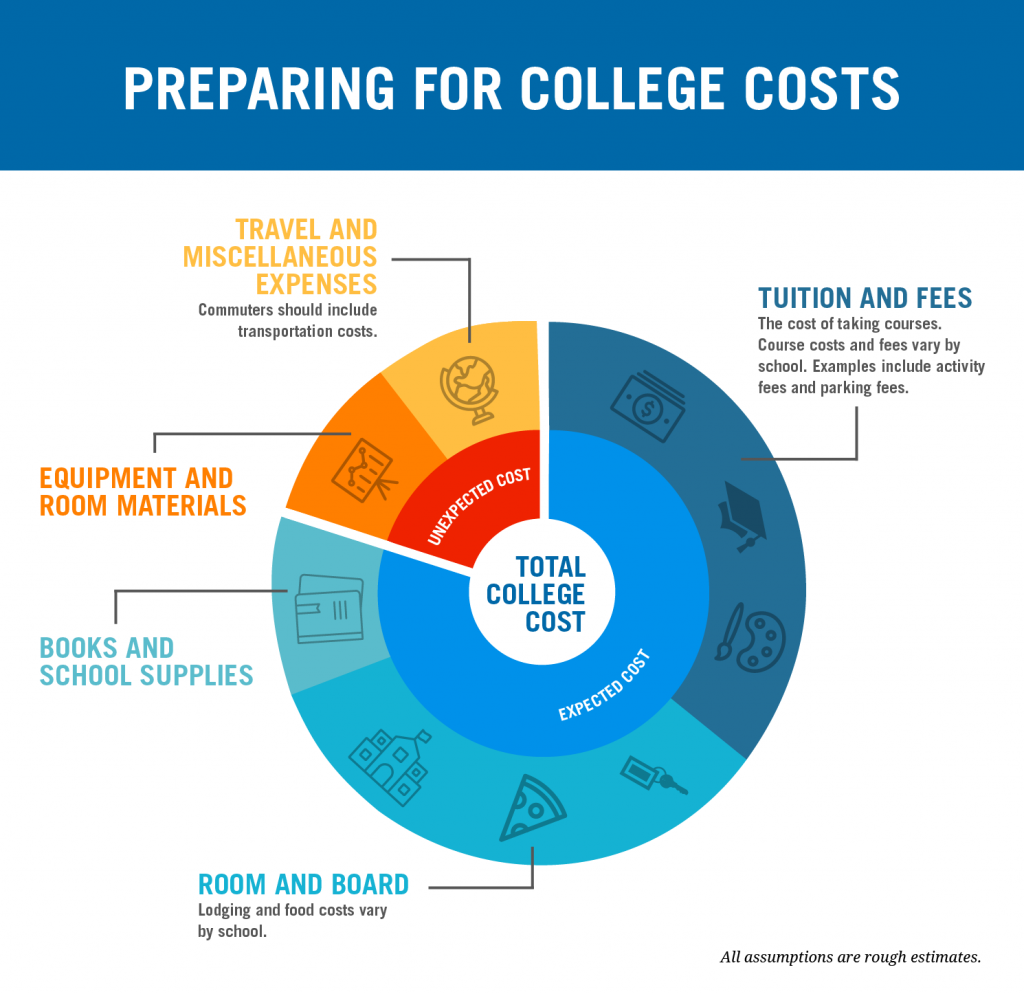

What Does the Cost Breakdown Look Like?

Before getting too deep into the research of what college or university you might want to attend, it’s a good idea to understand the total cost of applying and then actually attending a university. This information is best used with the support of a university financial aid office or admission counselor, to help you accurately determine and categorize costs.

Cost of Applying to College

There are a variety of costs to consider even before making your college list. Understanding these costs will help you budget and plan, smartly. Your first step in your college journey? Knowing how to dissect/determine fees in order to create a balanced and viable college list.

These are fees charged to subsidize the organizational costs of reading and evaluating applications. They are charged in a number of ways:

Centralized Application Fee: UC Application (UCLA, UC Irvine)

Individual Application Fee: The Common Application form, university-specific application

Centralized Fee with Individual Fee: Ontario system, UCAS

In the irony of all ironies, you may have to pay money just to tell universities that you don’t have enough money to attend. In order to request financial assistance, many institutions use a common financial aid application called the CSS Profile, which costs between $16-25 USD per school. The CSS Profile acts as a “financial aid calculator form.” Found online, the form is filled out with information from federal and bank documents to accurately show how much money students have available to pay for college. When submitted, applicants can be applicable for need-based aid after a college reviews the (true and honest) account of finances.

If your university list requires tests like the SAT, SAT Subject Tests, ACT, TOEFL, IELTS, or Duolingo English Test, there will be a fee to take the exams. Once you are done testing, if you know the schools to which you will apply, on the day of testing you can choose to send the scores, free of charge, to four colleges and universities—one more reason to start researching and have a balanced college list. If your list is not researched at the time of the tests, score reports will need to be ordered and paid for individually. Pros? Free tests to colleges. The Score Choice option allows students to use scores from the sections they scored highest over multiple test dates. Something to consider? Be ready for the exam(s) after taking ample time to practice; once you decide to send the scores, they are sent and filed by the university. On that note, many colleges are test-optional; to find out which ones are, check out FairTest.org.

If your applications are not electronic, you may have to send materials through the post office. This is the case for many overseas universities.

Note: Make sure you check the deadlines for your schools. Many have rules that state the application paperwork “must be stamped and dated/sent by” a specific deadline.

Some universities might require that your credentials be verified or validated by a legal or government entity. In some cases, it might be necessary for your documents to include an official translation with your documents or even an apostille, which certifies from one country to another that the document has been signed by a notary public.

After you have been accepted and decided upon a university, politely tell the others you will not be attending. You will be required to pay a deposit as a sign of commitment. The amount of this deposit varies from school to school and country to country. Even if you are a scholarship recipient, you may be required to pay a small, affordable enrollment fee to show your commitment to the school

Netherland’s Portal Studielink →$100 USD

Japan →$2000~$5000 USD

Australia →$90 USD

Once you have been offered and have accepted a place at a university, you will go through the process of obtaining a visa to study for the country wherein you plan to attend university. Visa costs vary by country but can range from $0 to $550 USD. Universities are able to provide guidance with the visa process; contact your admission officer for support.

Calculating the Cost of Attending University (COA)

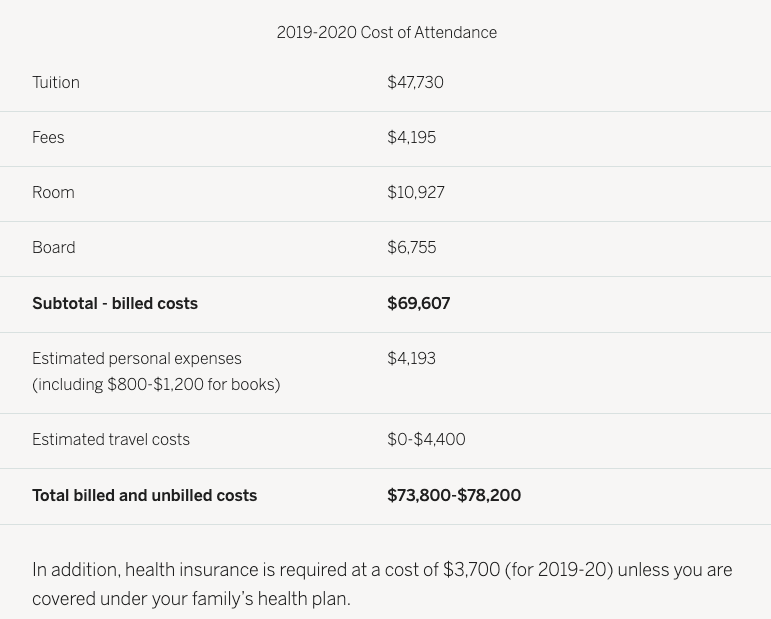

As you are researching to plan for the total cost of attending college, look for a breakdown of fees from the beginning of enrollment and throughout the academic year.

The cost of attendance will generally include:

| Visa (I-20 and other visa fees) | ---- indirect cost (you pay for it) | ||

| Tuition (classes) | ---- direct cost (you pay the university for it) | ||

| Room and Board (living and meal plans) | ---- direct cost | ||

| Health Insurance (mandatory) | ---- indirect | ||

| Additional Fees (varies) | ---- indirect | ||

| Personal Expenses (airfare, books, miscellaneous) | ---- indirect |

The COA can be broken down into two types of costs: direct cost (billed costs) and indirect costs (unbilled costs). Direct or billable costs are the fixed fees that you have to pay to attend college. This will at least include tuition and general fees, but in some cases, it might include room and board (U.S. only). Additionally, when researching the potential cost of a university, consider all the indirect costs associated with attending. This could include a variety of expenses, such as books, personal expenses, and transportation to and from campus.

Calculating indirect cost can be difficult. The type of college or university you select will impact these costs. For example, if you attend a university in the Netherlands, your indirect costs will include room and board in addition to other living and personal expenses. However, in the United States, indirect costs will vary depending on whether your plan is to attend a private college with mandatory residential programs or a community college.

*Mandatory health insurance through the university or approved by the university costs $2,500-$4,000 USD per year. Often, this is not included in the charts due to varying costs and options; universities usually provide links with more information regarding health care.

Tip: Have you searched all over the school website and can't find the cost of attendance? Look at its Common Data Set! Still can't find what you need? Reach out to an admission representative!

Creating a College Application Budget

Research is your biggest advantage in this process, along with knowledgeable adults. You are responsible for establishing your team, and now that you have a clearer understanding of the costs associated with attending college or university, it’s time to think about how much you’ll be responsible for and how much financial aid you may need.

While some of the fees below can be waived or paid by universities, as a savings goal, it’s best to keep all expenses in mind. The following is a list of potential expenses to help you establish savings goals to prepare you for your college adventure. Use the right column to note what expenses you are likely to have and add them up. Don’t forget to include an additional 10% of the total as a budget for contingencies (i.e., costs you didn’t or couldn’t predict).

College Budget Example:

| Category of Expense | Potential Costs | Potential Savings Goal | SAVINGS GOAL |

|---|---|---|---|

| HIGH PRIORITY | |||

| Enrollment Deposits *Enrollment deposits are sometimes waived by universities for students with demonstrated financial need. |

Varies USA/CANADA Enrollment Deposit $300 USD Housing Deposit $100 USD UK Enrollment Deposit £1000 ASIA Up to $8000 USD. The most expensive deposit payments will include the first-semester tuition payment. |

||

| Visa Fees *U.S. ONLY: The SEVIS fee may be paid by the university for students with demonstrated financial need. |

USA SEVIS Fee $350 USD Visa Appointment Fee $160 USD Reciprocity Fees (varies by country) UK Visa fee (applying outside of UK) £322 |

||

| Legalization of documents | Varies Do research to determine if this cost applies to you! Remember that there may be separate fees for getting documents and having them notarized. Also consider the cost of postal or courier services. |

||

| Health Checks and Vaccinations | Varies Do research to determine which vaccinations you might need! ★ Some university health insurance plans will cover vaccinations once you arrive in the U.S. Ask the university rep for details! |

$1,000 USD |

|

| Travel to University These expenses will cover transportation from the door of your house to the airport, the flight, and transportation to your university/housing. | Varies | $4,000 USD |

|

| SECOND PRIORITY | |||

| Getting Started Expenses Financial aid often includes funding for personal expenses and books, but this may not cover other major expenses, such as a computer, phone, or winter clothes. |

Varies What sort of items do you think you’ll need to start school? |

||

| Personal Expenses To cover expenses until your first paycheck from work-study is available |

Varies | $1,000 USD |

|

| Sub-Total | |||

| Emergency Fund (10%) | |||

| TOTAL SAVINGS GOAL | |||

Click here for a downloadable template that you can copy and fill out for yourself.

Understanding Estimated Family Contribution (EFC)

The Expected Family Contribution (EFC) is a term often used by U.S. universities to estimate, by analyzing certain documentation, an amount you and/or your family can contribute toward the cost of attending college. This is not a definitive number the family is expected to pay, but rather a starting point for the institutions to build from when creating financial-aid packages.

EFC uses a formula that takes into account taxed and untaxed income, assets, savings, and benefits.

Start with an honest financial inventory. To do that, you should have a conversation with your parents, relatives, potential contributors … anyone who has a financial stake in your education. During this conversation, agree on a realistic annual Estimated Family Contribution (EFC) for each of the four years you will be in college. Remember, your EFC should represent the maximum contribution possible toward your college education, or what your family is able to pay, not what they want to pay.

How much can my family contribute to my education? (total contribution, including airfare, personal expenses, health care, etc.)

Does this school meet full demonstrated need?

Do financial-aid packages cover any indirect costs?

Is there a minimum EFC required to attend this college?

What effect do merit scholarships have on need-based financial-aid packages?

Do financial-aid packages for international students include loans?

My Responsibility: The Search for Fit

The goal of this process is to find the post-secondary pathway that is the best fit for you. Maybe that’s going to college to study architecture, or maybe it’s taking a gap year, or maybe it’s taking a shot at starting your own business. Careful research will help you find the pathway to best match your goals.

To find the best fit, you need to thoughtfully consider what you want and reflect, realistically, of what you are capable of. You also need to know what options are available to you out there in the world. That’s where research comes in. EFC limitations should play a major role in guiding initial school search. High EFC affords more options. Low EFC requires more detailed research into the school’s admission and aid award policies.

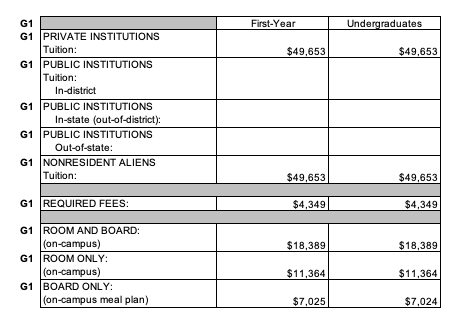

The Common Data Set (CDS) initiative is a collaborative effort among data providers in the higher education community and publishers as represented by the College Board, Peterson’s, and U.S. News & World Report. The goal of this collaboration is to improve the quality and accuracy of information provided to all involved in a student’s transition into higher education, as well as to reduce the reporting burden on data providers. The CDS is an excellent tool for breaking down quantitative data for a university. Categories like: How much funding goes toward international students? What is the breakdown of the student body population? How does a school rank, in order of importance, parts of the application? All this information and more can be found in this document. Here are some sections of the CDS we find to be useful in the college/university research process:

Section B

This section breaks down general enrollment by categories such as cohort, gender, and racial/ethinic identity. If diversity is important to your college experience, this will be a useful section for you!

Section G

Reminder: Section G outlines the COA for the university. Understanding how and where the money goes is an important part of your research.

Section H

In this section, you can examine the average financial aid awarded to international students by the college/university. Out of the H categories, H6 is the most important: Aid to Undergraduate Degree-seeking Nonresident Aliens, also known more simply as: international students. Here you’ll find the total number of international students receiving institutional financial aid, the average amount awarded, and the school’s total budget. If the average financial aid award is significantly lower than your EFC, then this school is likely not a fit for you. Why? Because, even if you are accepted, you may end with a gap; gapping is when a college offers a financial aid award that does not meet a student’s full financial need.

Let’s review: From this Common Data Set, we can gather the following details about the school:

Average need-based aid package to international students is $64,000 USD.

Total institutional aid awarded to international students is approximately $38,000,000 USD.

International students make up approximately 13% of the student body

Total number of students receiving aid is 590, which likely means about 147 students per class are receiving some sort of aid. It can also be assumed that approximately the same number of incoming students are likely to receive a similar average financial-aid package.

Conclusion: This school will be extremely competitive for a high-need student.

Non-Traditional or Alternative Pathways to College

Who said U.S. colleges were the best options for you and that post-secondary pathways had to be direct college pathways? There are myriad non-traditional or alternative pathway possibilities available for students. These are amazing confidence-building, skill-building, money-saving choices for students who have found that the structures of traditional education are not for them, or for students who maybe just aren’t ready to dive into the college experience yet. Choosing this path might seem daunting, but with careful planning, you can find a successful path that’s your “best fit.” Here are some alternatives you can pursue:

Geoswerve © your applications

Community college

Studying in one’s own country for a first degree, then leaving for a second

Entrepreneurship projects

Vocational training

Gap year

Work force

Note: Geoswerve is a word coined by the Nepal Justice League counseling team. It means to geographically swerve applications to a country or location that may not be initially on one’s radar. Typically refers to swerving to non-US universities. ©

Speaking of alternate pathways, here are a few hacks and tips for lesser-known ways to save some money:

Submit your SAT/ACT score in lieu of a proficiency test

Duolingo English Test, when accepted, instead of TOEFL/IELTS/Cambridge or others

Test Optional and Flexible Schools to avoid testing

Use Your Four ACT/SAT Free Score Reports to avoid paying to send your scores

Merit Award given automatically by universities

Local Resources such as churches, private companies, the Rotary Club or a Ministry of Education

How do I begin?

Visualizing the road ahead is helpful in preparing you for your goals. Planning for college is no different. We like to start with a calendar and/or timeline of some sort, especially when it comes to financing your education, since there are many deadlines and opportunities that may make getting a post-secondary education more affordable. Take some time to write out a timeline of what your college application season should look like, aligned with your school system. Below is an example to give you an idea of what you can create! Remember, the application season runs for about 12 months total (each university having its own preferred deadlines), from August to August. To apply, you must be receiving a high school diploma or equivalent within the timeframe. Note: If you have matriculated to college already, it is important to get in touch with an admission representative to understand how this may change your application status and potential financial package.

For a longer timeline guide outlining your junior and senior years, click here.

What Documents and Forms Should I Prepare to Find and Fill Out If Required?

The CSS Profile is a financial-aid application used to determine the need for institutional financial aid. Colleges use this application to:

See a larger picture of the family’s finances

Understand the family’s true financial need

Help award aid to students who truly need it

Distribute aid in an equitable manner

The CSS Profile is a very in-depth form, so your family may be expected to provide additional documents with the application (e.g., recently completed tax returns, other records of current income, records of untaxed income and benefits, assets, and bank statements). Your family will report their income from two years prior to the year you plan to attend college. Also, the CSS Profile requires financial information from both parents and their spouses. You can report in your home currency.

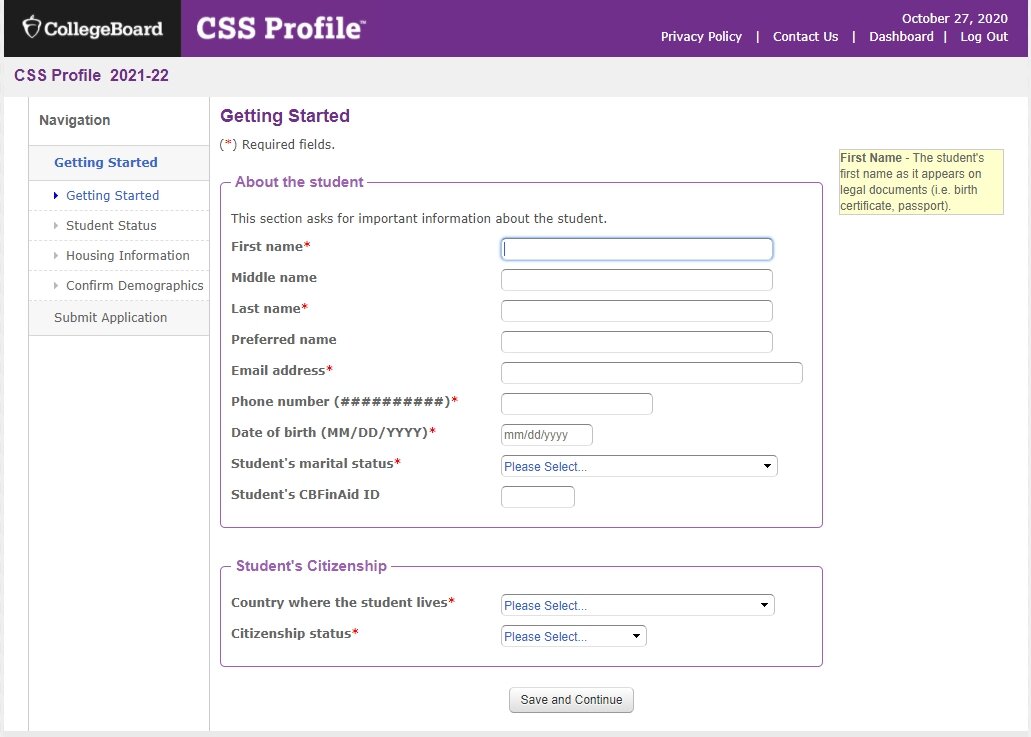

Create an account or log into your College Board account.

Select the correct application year.

Complete the application … and pay the fee.

Know what tax year information to prepare ahead of time (two years prior, “prior-prior year”).

Have your documents ready and available when you start filling out the application.

The questions in this section are about you, not your parents/guardians. These questions are extremely important in setting the CSS Profile up to work correctly. A mistake in this area can impact your whole application!

This section is a report of your parents/legal guardians—all of them: living parents, deceased parents, current stepparents, a parent’s current partner, legal guardians, legal guardian’s spouse. You can report up to four parents.

This question references where your parent(s)/legal guardian(s) currently reside(s). Do not report their country of birth or citizenship here.

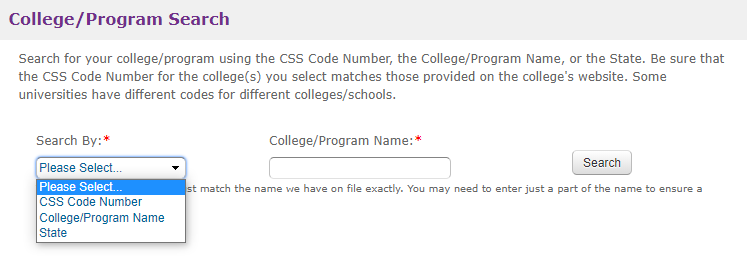

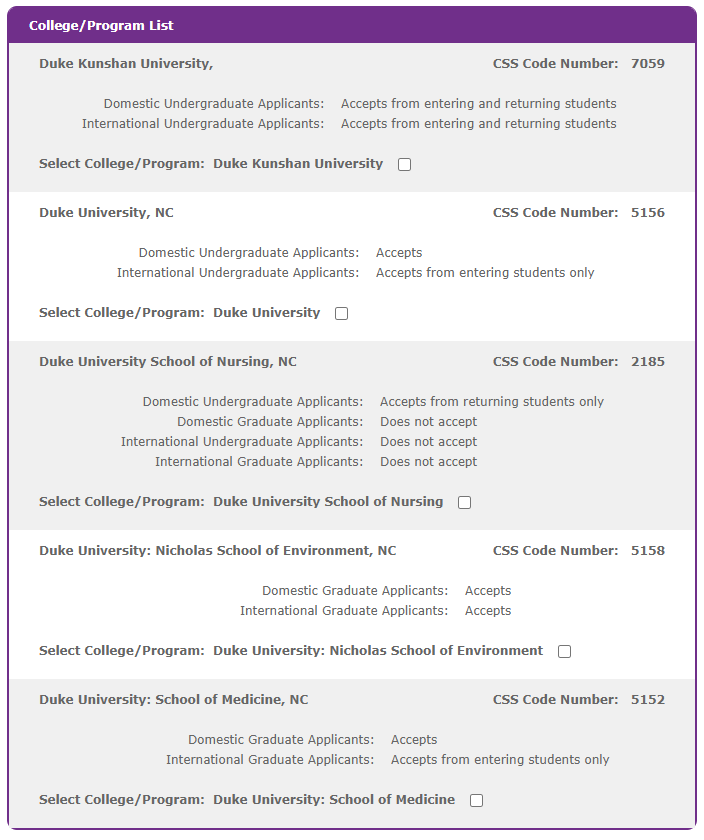

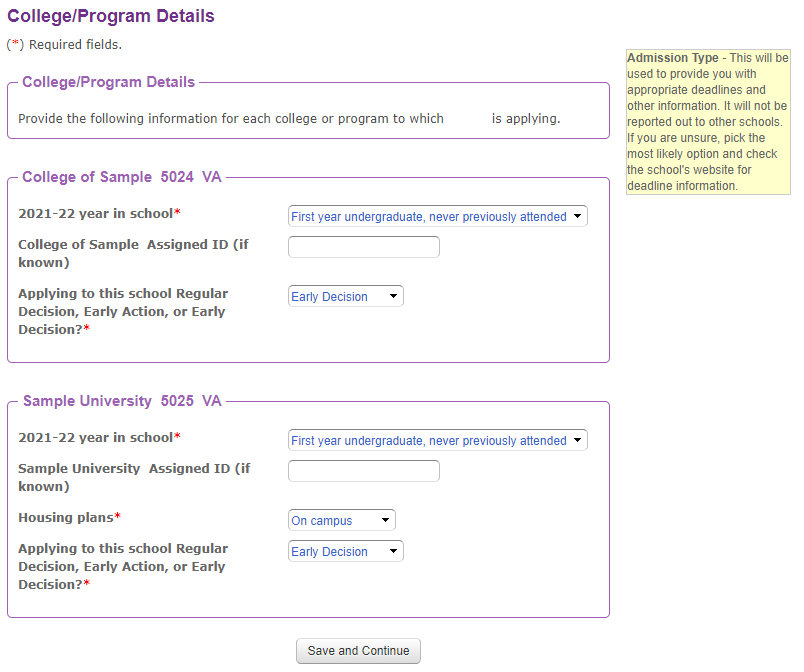

In this section, you’ll find the colleges and universities to which you plan to apply to. If your school lists a CSS code, be sure to input it here!

Make sure to select the right college and program. For example, you should not select a graduate school, medical school, or law school. Selecting the wrong type of school could delay your application.

Can’t find your college or university? Make sure your college accepts the CSS Profile from undergraduate applicants. Some institutions have their own application or use the ISFAA.

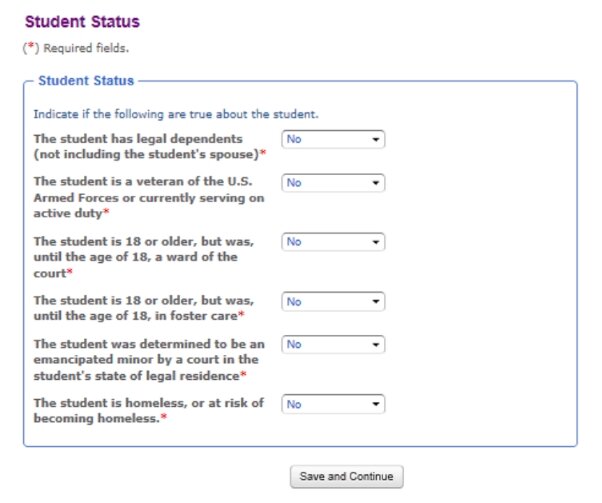

For many institutions, you must be a first-year student in order to apply for financial aid. You are considered a first-year student if you:

Earned college credits while in high school

Were enrolled in college courses while in high school

Income and Assets of Parents and Students

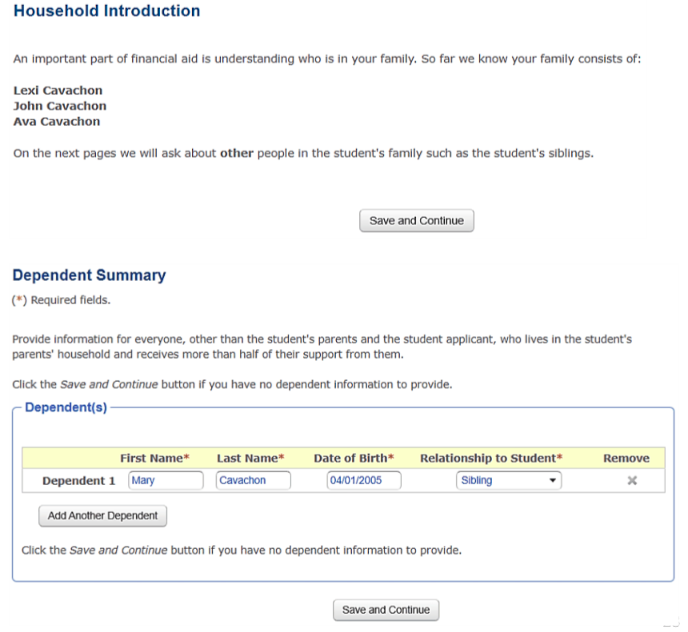

Family members living in the same household, but who are supporting themselves financially, do not need to be reported.

Expenses are factored in when calculating a student’s EFC. In the CSS Profile, you will be prompted by questions to help determine your EFC. The profile also takes into consideration economic principles, such as cost of living, savings allowances, and tax allowances, in its calculations.

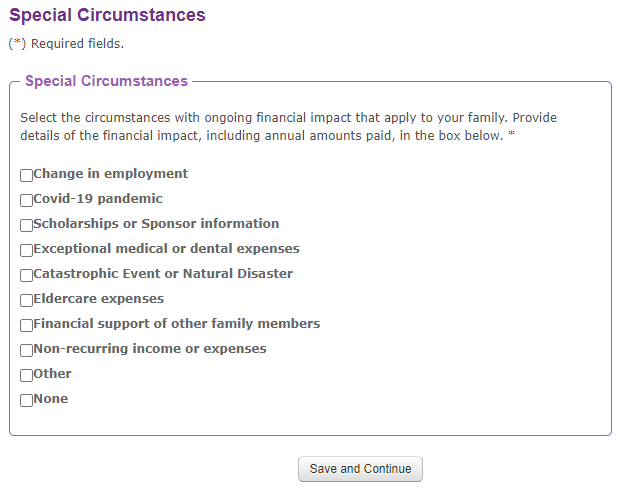

Use this section, if you have a situation that is not clearly expressed through the financial-aid application—i.e., if a parent or guardian has a change in their employment or high medical expenses—this is the section to explain the circumstances.

If you have a noncustodial parent (a parent who doesn’t have guardianship/custody of the student applicant), they will need to complete a separate CSS Profile account. This is technically “a student account” with your parent’s information. Similar to the student’s CSS Profile application, the parent will complete the student sections of the application with the student's information and the parent sections with the respective parent’s information.

Be sure to create this account using the parent’s information, not the student’s.

If you have no contact with your noncustodial parent, you can request Non-Custodial Waivers directly from the school.

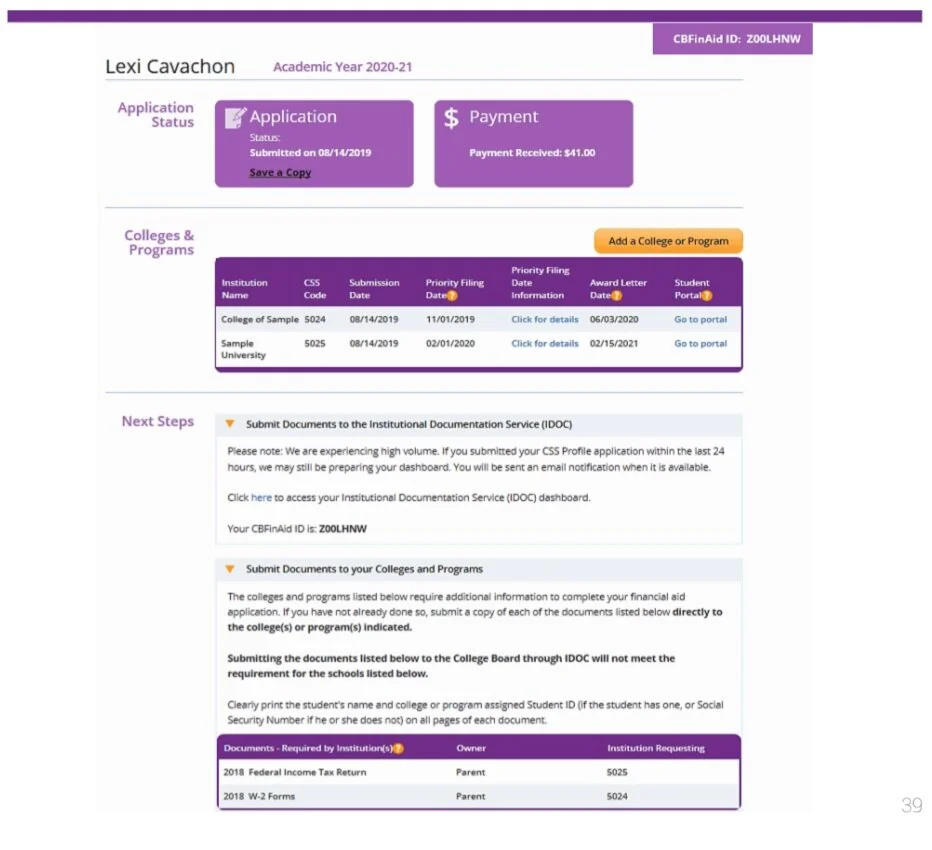

Once you complete everything (listed before this), the CSS dashboard appears and lets you see the status of your applications, payment receipts, deadlines, and college information/details. Unfortunately, there is no CSS Profile fee waiver available. The CSS Profile costs $25 USD to fill out and submit to one college, then $16 USD for each additional choice.

Missing the financial aid deadline means you will not qualify for any aid for your first year of school. To preempt this mistake, we highly recommend treating the college application deadline as the deadline for the financial-aid application.

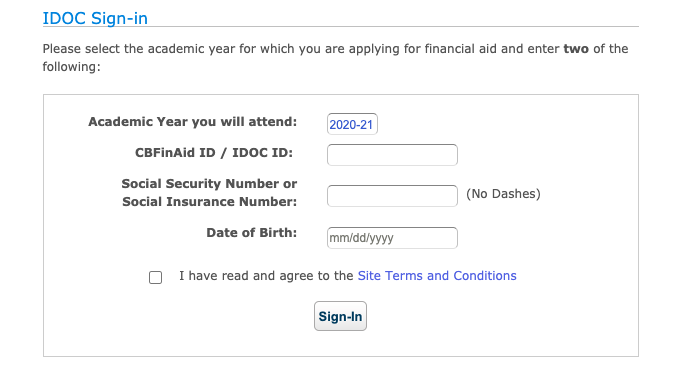

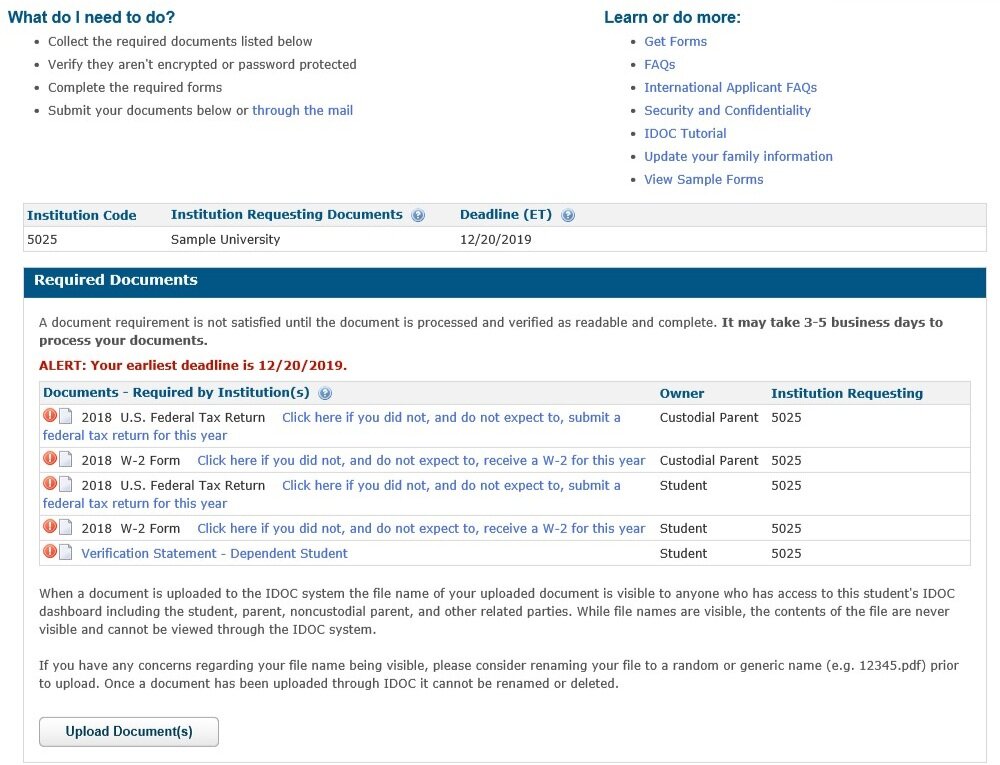

Once you submit your CSS Profile, you may need to send supporting documents to the school. This is where IDOC (Institutional Documentation Service) comes into play. Students who are required to submit documents will receive an email from the College Board with login details to IDOC provided. In IDOC, students will be asked to upload documents such as tax forms, bank statements, and/or other financial aid documents for you and your parents. Be sure to submit your documents by the set deadline!

You will get an email from the College Board notifying you if you need to submit documents through IDOC. Until then, you cannot sign in.

Institution-specific documents are found in the Get Forms link in IDOC. Most forms require a handwritten signature, which means the student should print and sign the form, scan, and then upload it to IDOC. Once a document is uploaded, you can find it in the Uploaded Documents section. Processing may take 3-5 days, so be patient.

How to Use the International Student Financial Aid Form (ISFAA)

The ISFAA is a financial-aid application used to determine the need for institutional financial aid. Colleges use this application to:

Understand the family’s financial need

Help award aid to students

This is a free, paper-based application available for download on the respective school’s website. Students are required to convert income and asset information into U.S. dollars (USD) and provide additional documents with the application. For example, recently completed tax returns, records of current income, records of untaxed income and benefits, assets, and bank statements could be required. Your family will report their income from one year prior to the year you plan to attend college with this application.

For the ISFAA, “parents refers to custodial parents, or the parent or parents with whom you live.” In this section is a chart to report all your family members (except for yourself) dependent on your parents’ income.

This section covers your family’s financial information. Remember, for the ISFAA, you must report this data in USD. Any income your family is receiving goes here.

You must report all income in your financial-aid applications. Income includes:

Money earned from work (wages)

Self-employment income

Business income

Income from investments, dividends or retirement payments

Income plays an important factor in determining EFC.

Most money and property owned by your family will be counted as an asset. In this section, write the value of assets and any debt counted against the asset at the time you complete this application.

Assets include:

Savings

Land owned

Business equity

Home equity

Families are not expected to contribute all their assets toward their child's education. On the contrary, only a reasonable percentage of assets reported on your financial aid applications will be taken into account when determining EFC.

In many cases, expenses are factored in when calculating a student’s EFC. Why? Family expenses and other commitments impact your family’s actual available income. You must use specific amounts for each category listed (if applicable). If you do not know the exact amounts, provide an estimate.

In this section, identify the amount of money you and your family are able to contribute toward your education. You should never leave this section blank or put “zero” in each category if you are able to contribute. If you can contribute only $500 USD per year toward your education expenses, then list it.

These amounts may not be what you will be responsible for.

Schools might compare their calculated EFC to your listed “expected support” to determine an appropriate contribution for your family.

Families should include information in this if they have experienced unexpected and uncontrollable changes in their financial circumstances. Examples of these changes include:

• Loss or change in employment

• Loss due to recent natural disaster

• High medical expenses

• Unusual family expenses (e.g., eldercare)

Changes to your Financial Aid Application

In both applications, there is a section for families to explain any special circumstances universities should consider when reviewing their application. In some cases, financial situations might change while the application is being processed. Or maybe you found an error in your application after you submitted. Always inform the colleges of any special circumstance and errors to give yourself the best chance at receiving aid. Because funding is limited, it is important you update the college with these changes as soon as possible.

You’re in—now what? How do you choose your best “financial” fit?

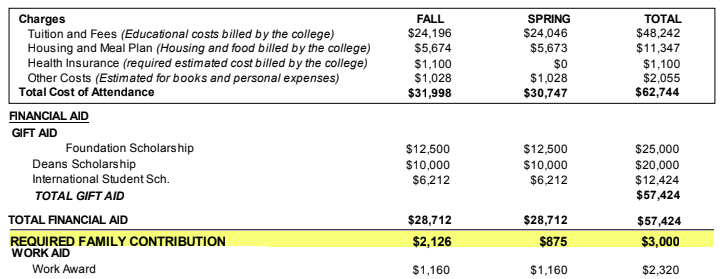

It’s important to review your financial aid packages carefully in order to understand everything you’re responsible for. You might get a full ride, which covers all billable expenses, leaving you responsible for expenses such as health care, books, and transportation costs. Look over your package line by line to see what’s included. The package may also include merit loans, which have academic minimums you must maintain, or loans you must repay after graduation. Let’s look at a few packages to understand how different universities distribute their funding.

A Brief Guide to Analyzing Your Financial Aid Award Letters

This award letter is very clear and breaks down the COA and award for the student. College C has awarded three scholarships: a Davis Foundation Scholarship, the International Student Scholarship, and the Dean's Scholarship, giving this student a total of $57,424 USD in gift aid. There are no loans in this aid package. The student’s work study is labeled “work aid” and totals $2,320 USD.

Putting your packages side by side in a chart really helps you compare what each school covers and what you are responsible for.

If you’re not clear about what’s included in your package, reach out to your college counselor or admission counselor for help!

Need more help?

For a slightly longer guide to reading your Financial Aid Award Letters, including a downloadable template, click here.

STILL NEED SOME MORE MONEY? HOW TO THOUGHTFULLY APPEAL A FINANCIAL AID OFFER

While not guaranteed, it is sometimes possible to make a "Financial Aid Appeal" to a university and have your financial situation reexamined. Financial appeals should be made to the one school, if given the right financial aid package, you would definitely attend. Your appeal not only should ask the university for flexibility, but also show your flexibility regarding your family's contribution.

How likely is it that colleges and universities consider an appeal? It usually depends on whether there are still funds remaining in their financial aid budget . This process will differ depending on the institution, so check the school’s website or contact the financial aid office about the process for appeal.

What is considered a reason for appeal?

Errors in original information

Recent change in employment or income

Change/increase in support of other family member(s)

Exceptional medical expense

What’s often not considered a reason for appeal?

Wanting more financial aid, not simply needing it

Using another institution’s financial aid offer to try and negotiate

Fluctuations in exchange rates

When you’re appealing your financial-aid package, you should be ready to show why the original package did not meet your family’s demonstrated need. This can be done by submitting supporting documents and explaining the situation in writing. To show your commitment to making this work, we recommend that you try to meet the school “half way.” A sample letter can be found in the section below.

Want to see an example?

For a longer guide on how to write a letter of appeal, including examples, click here.

Gratitude and Grace

As you approach the end of the college application season, don't forget about grace and gratitude. Whoever had a hand in getting you to this finish line, show them your appreciation and thanks. Remember to take a moment to share your news (good or bad) with the people who wrote letters for you, who sat up late with you as you barely made that deadline, or who had a kind word for you when things felt complicated. With your mind and heart open, remember that a tactful show of appreciation can come in the form of a handwritten note, personalized email, a video chat, or even a face-to-face. Whatever you decide to do, do it with intention.

Here is a sample letter from students to inspire you on your path to gratitude.

Dear TEACHER/COORDINATOR/COUNSELOR:

I hope this email finds you well. With my last milestone as a high school student finally over, I wanted to thank you personally for your support.

Thank you for not only helping me with so many personal matters, such as figuring out what I want to be in the future, but reminding me of who I am during the process. While I am still not sure where exactly I would like to be in a couple of years, it is my firm belief that I hope to be a voice for those less privileged than I am.

I am grateful I had such powerful educators such as yourself to support me throughout.

Thank you again for everything. I hope to keep in touch with you.

Sincerely,

STUDENT