This lesson covers...

The five types of colleges every student should explore before finalizing their college list

Time

8 minutes

By the end you should...

Know the real difference between public and private colleges

Have identified which college types are most likely to be financial fits for you

For financial aid purposes, there are five types of colleges:

Public In-State Universities

Public Out-of-State Universities

Private Colleges/Universities

Two-year Colleges

International Universities

In an effort to streamline this section, I’m purposely skipping over two types of colleges for which your Financial Fit Quadrant doesn’t really matter: service academies and for-profit institutions.

Service Academies

The five US military academies (also known as federal service academies) are perhaps the single most affordable type of college: they are free for everyone who gets in.

Why doesn’t everyone just go to these?

- They are really, really competitive to get into.

- Not everyone wants to join/make their career in the military.

If this college type sounds like something that could work for you, you can start learning more here.

For-Profit Colleges

The second college type I am purposely excluding from our list are for-profit colleges. As a student advocate, there is no possible way I can endorse these colleges given their collective track record as institutions that leave students with incredible debt, questionable outcomes, and non-transferable credits.

Below, you can navigate to learn about each of the 5 types and why it likely is or isn’t a financial fit for you based on your Financial Fit Quadrant. But before you do, I have two quick things I’d like to impart to prepare you to make the most of your time in this section:

An understanding of the actual difference between public and private universities

A ranking of how affordable each of the five types are likely to be based on your Financial Fit Quadrant.

Public vs. Private Colleges: What’s the difference?

Important Difference #1

Public universities are partially funded by the government of the state in which they operate.

Your folks pay taxes. Those taxes flow to the state government, which then spends them on the universities funded and operated by the state. In contrast, private colleges mostly operate independently of state influence and funding. As a result, public universities typically have much lower sticker prices ($15,000-$30,000) than private colleges ($25,000-$75,000). That said, this lower sticker price only applies to students who qualify for in-state tuition. Typically, this means you (or your parents) have to live in the same state as the college in order to avoid paying the out-of-state tuition rate which is typically much, much higher ($30,000-$55,000).

More on this in the “Out-of-State Public Universities” section.

Important Difference #2

Private colleges are far more likely than public universities to make their net prices flexible through discounts, particularly scholarships.

So a private college with a sticker price of $50,000 could easily drop to $20,000—the cost of a public university—for a student with great academic achievement. Conversely, because public universities already have comparatively low sticker prices for their residents as well as (usually) much bigger applicant pools, earning a scholarship at a public university is far tougher to do unless your state has a built in merit-based program.

More on this in the “Public In-State University” section.

Based on these differences, you may already have a good idea of which types of colleges are more likely to offer you an affordable price. And you’re probably right.

Below I’ve ranked the most promising college types based on your Financial Fit Quadrant. Once you’ve reviewed the information for your quadrant, skip down to your next Action Step.

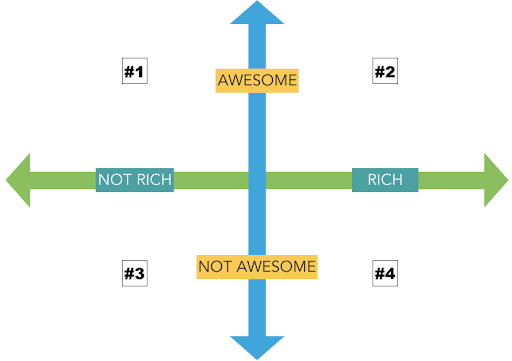

College Type Affordability Ranking by Quadrant

Quadrant #1 (Awesome, Not Rich)

Your combination of high achievement and high need position you for the best of both worlds: merit-based aid (scholarships) and need-based aid (grants). You’ve got lots of options!

Your Typically Great Financial Fits

Private Colleges

Public In-State Universities (This could tie for #1 depending on your state.)

Two-year Colleges

Your Typically Not So Great Financial Fits

Public Out-of-State Universities (Though there are exceptions!)

International Universities

Quadrant #2 (Awesome, Rich)

Scholarships and low sticker prices are the name of your game. You’re looking for colleges that will either reward your awesome grades, scores, and talents or that simply have a sticker price your folks can afford out-of-pocket. Or ideally both!

Your “Most Likely to Reward Your Talents” Fits

Private Colleges

Your “Most Likely to Afford Out-of-Pocket” Fits

Public In-State Universities (May also give you a scholarship depending on your state!)

Two-year Colleges

Your “It Depends” College Types

Public Out-of-State Universities

International Universities

Quadrant #3 (Not awesome, Not Rich)

Believe it or not, you’ve got some awesome options. The fact that you qualify for need-based aid (grants) through the FAFSA and maybe even a state program means that, once you’re admitted, some colleges could be quite affordable.

Your Typically Great Financial Fits

Public In-State Universities

Two-year Colleges

Your “It Can Depend” College Type

Private Colleges

Your Typically Not So Great Financial Fits

Public Out-of-State Universities

International Universities

Quadrant #4 (Not awesome, Rich)

The fact that you likely won’t qualify for grants or scholarships, means we’ll need to be a bit more creative. That said, public options are likely your best bet, but certainly not the only avenue.

Your Typically Great Financial Fits

Public In-State Universities

Two-year Colleges

Your “It Can Depend” College Types

International Universities

Private Colleges

Your Typically Not So Great Financial Fit

Public Out-of-State Universities

[action_item]

Action Item: Decide which college type you want to explore first based on what you just learned.

- Public In-state Universities

- Public Out-of-State Universities

If you have a specific college in mind that you’d like to explore, you can start with its section type to learn about ways to make it affordable or, if your parents are around to give you the financial info you’ll need, skip straight to its NPC like we talked about last section.

If you’re not sure where to start or afraid of missing anything by jumping around. No worries. Let’s start with the option that’s most popular for most students and go from there.